Eye on the Middle East Nov/Dec 2011

The late Golda Meir, fourth prime minister of the State of Israel, once said, “If Moses had turned right instead of left when he led his people out of the Sinai desert, the Jews would have had the oil; and the Arabs would have ended up with the oranges.”

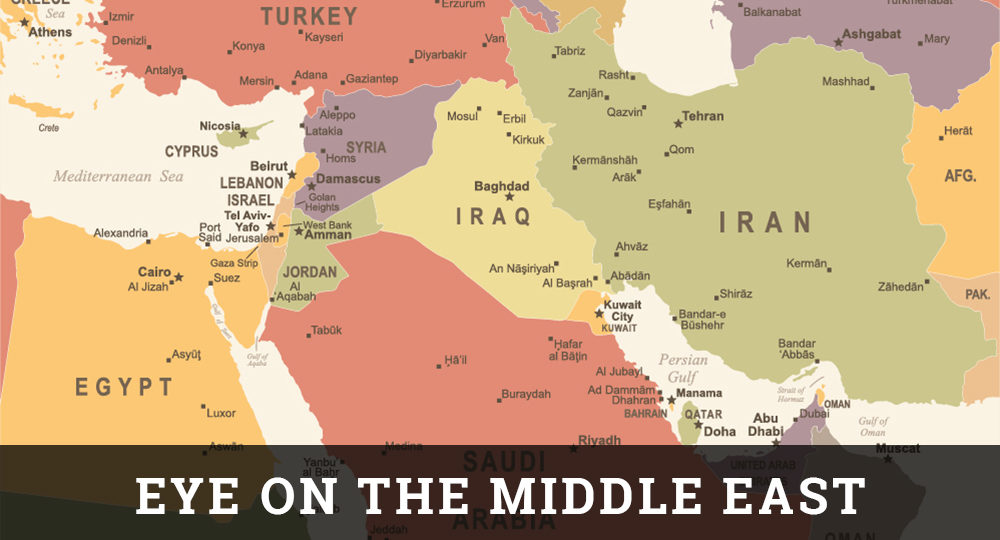

That was Golda’s humorous explanation of Israel’s energy deficiency, while energy-rich neighboring countries hold billions of barrels of the world’s oil reserves: Saudi Arabia, 262.2 billion; Iran, 136.3 billion; Iraq, 115 billion; Kuwait, 101 billion; United Arab Emirates, 97.8 billion; and Libya, 41.5 billion.

These nations effectively use their oil reserves as a weapon to influence oil-dependent Western countries to oppose Israel.

However, that reality may be about to change. Israel is sitting on at least 250 billion barrels of oil. The oil is not liquid but solid, formed in a rock called shale. Thirty miles southwest of Jerusalem lies the Shfela basin, which holds the second largest deposit of oil shale in the world. Although Israel has long known of the oil shale’s existence, it has been unable to extract the oil due to the expense and potential harm to the environment.

The online magazine Business Weekly said, “Oil shale has broken many hearts” because it is difficult to extract the oil safely and profitably. So what has changed in the Middle East?

Enter Howard Jonas, ardent Zionist, philanthropist, and founder of IDT Corporation, a telecom company. Jonas said he believes that sitting under Israel “is more oil than under Saudi Arabia.” Several years ago, while working on oil shale in Colorado (the largest deposit in the world), Jonas began to think about the oil in the Shfela. So he started a spinoff company called Israel Energy Initiatives (IEI). He knew oil companies would be reluctant to explore the oil business in Israel for fear of adversely affecting their relationships with Muslim-controlled oil suppliers.

So Jonas assembled a veritable who’s who of investors and oilmen who have no such concerns and are longtime friends of Israel:

- Rupert Murdoch, chairman of News Corporation empire, on record as opposing what he calls the Muslim terrorists’ “war against the Jews.”

- Michael Steinhardt, experienced hedge fund investor, Zionist, and philanthropist.

- Lord Jacob Rothschild, banker and philanthropist whose family has a long history of Zionist support.

- Eugene Renna, former president and chief operating officer of Mobil Corporation and retired executive vice president of ExxonMobile.

- Allan Sass, former president of Occidental Oil Shale, a subsidiary of Occidental Petroleum.

- Dick Cheney, former U.S. vice president and former president of Halliburton, one of the world’s largest providers of products and services to the oil and gas industry.

Jonas then lured Dr. Harold Vinegar, retired chief scientist with Royal Dutch Shell, to lead the team. Vinegar pioneered oil extraction from rock and holds some 240 patents. IEI believes that, under Vinegar’s leadership, extracting the oil will cost $35 to $45 a barrel and will keep the environment safe.

Investors on Wall Street seem to agree. Through the establishment of Israel Energy Initiatives, IDT stock—which had dipped to a low of 66 cents per share—rose (as of this writing) to $20 per share. Investors are not the only ones paying attention. European and Asian countries, new customers of Israel due to Israel’s recent discovery and production of natural gas, also are watching.

If Israeli technology can extract its own shale oil cheaply and safely, it could then market its know-how to help extract the more than two trillion barrels of shale oil around the world. Israel, a stable democracy, would be-come a wonderful alternative source of oil and related technology.

Imagine the prophetic implications of Israel as a world-class producer of oil. Little did Golda know: Moses made the right turn after all.